Offer in compromise How to Get the IRS to Accept Your Offer Law

TAS and the IRS collaborated on two significant changes to the OIC refund offset policy. First, for offers accepted on or after November 1, 2021, the offer in compromise refund recoupment process, explained below, will no longer be applicable for tax periods included on the Form 656. And second, while refunds may still be offset during the time.

Irs Offer In Compromise Form 656 Form Resume Examples 0g27jx0VPr

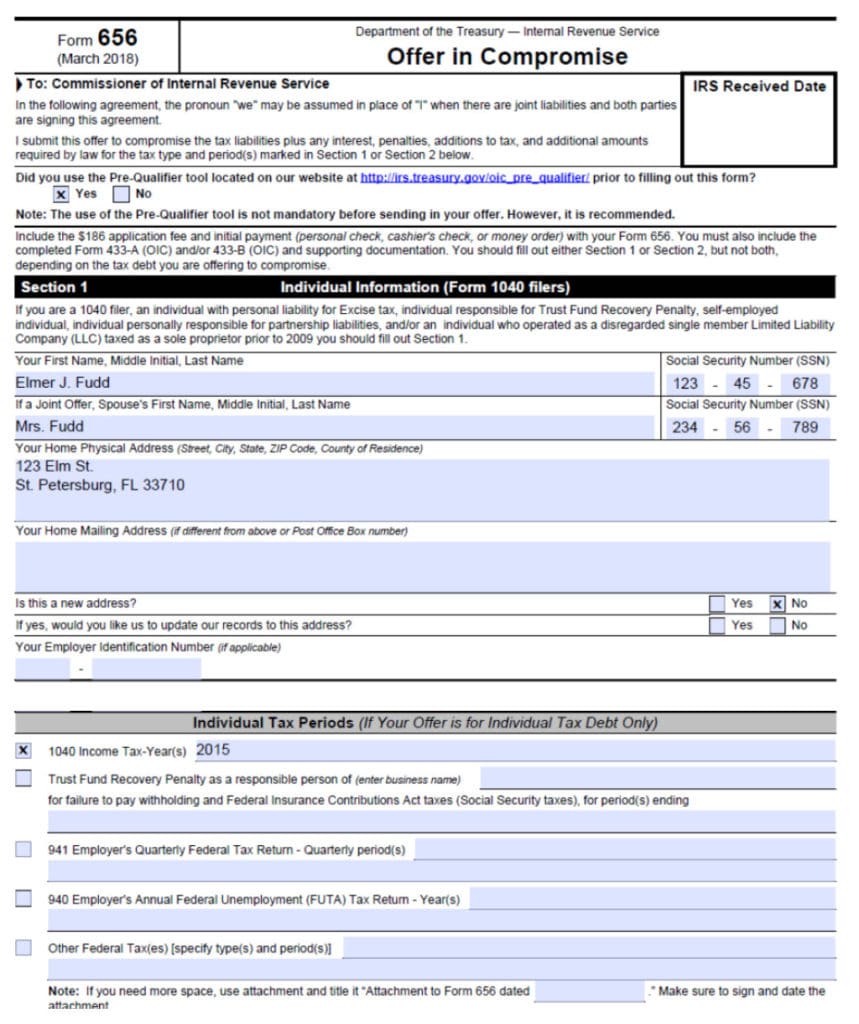

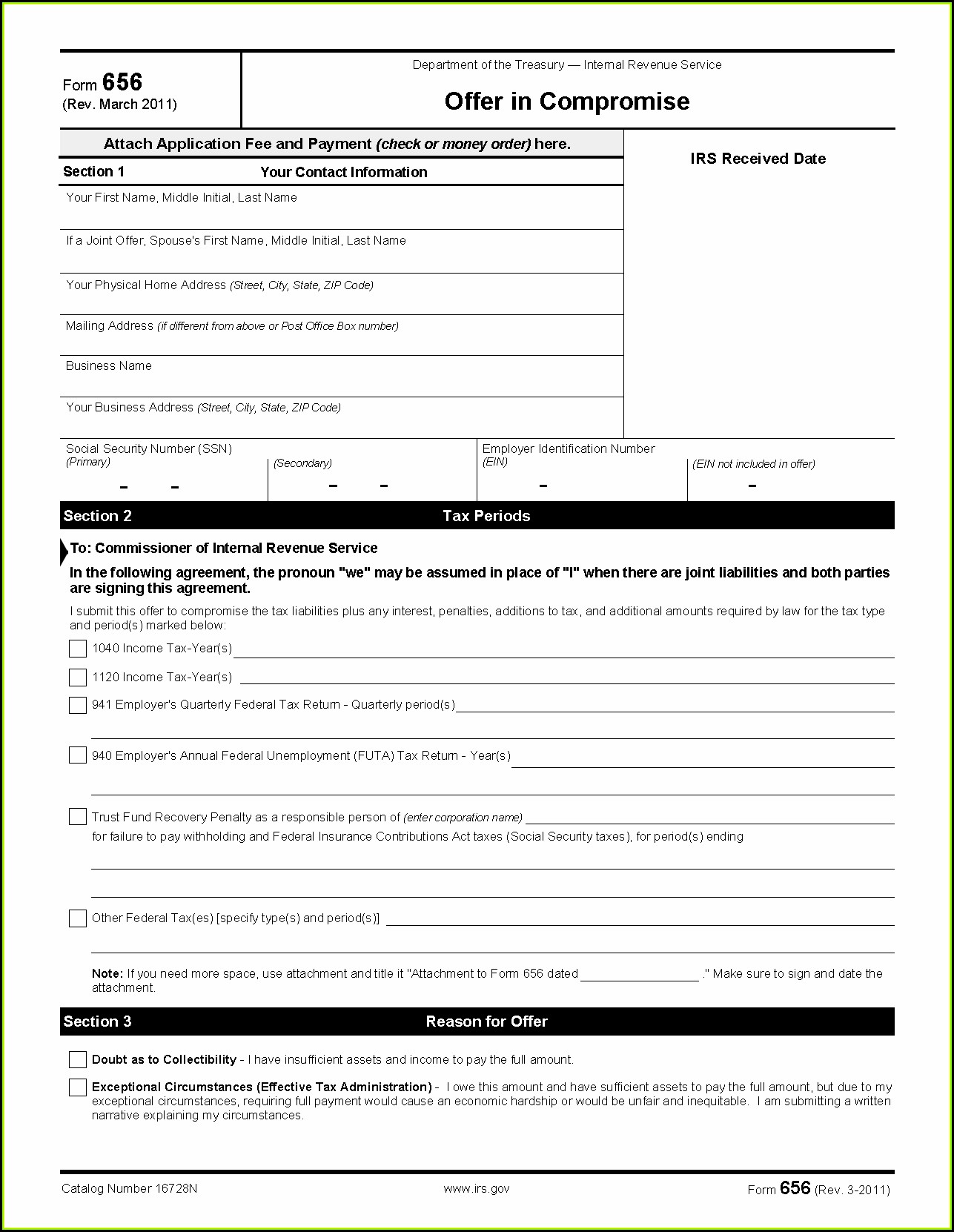

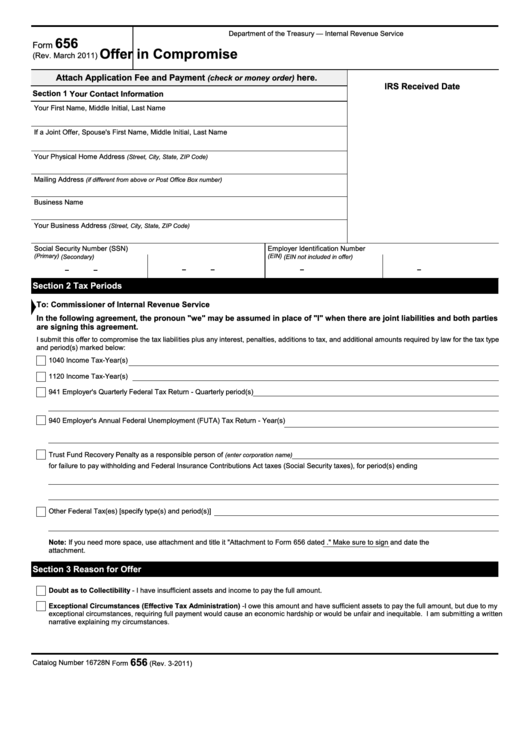

The IRS Form 656-B booklet offers more information on who qualifies for this option. Note, the IRS released a new version of this form in April 2023, so make sure you are using the latest option.

IRS Form 656L Download Fillable PDF or Fill Online Offer in Compromise

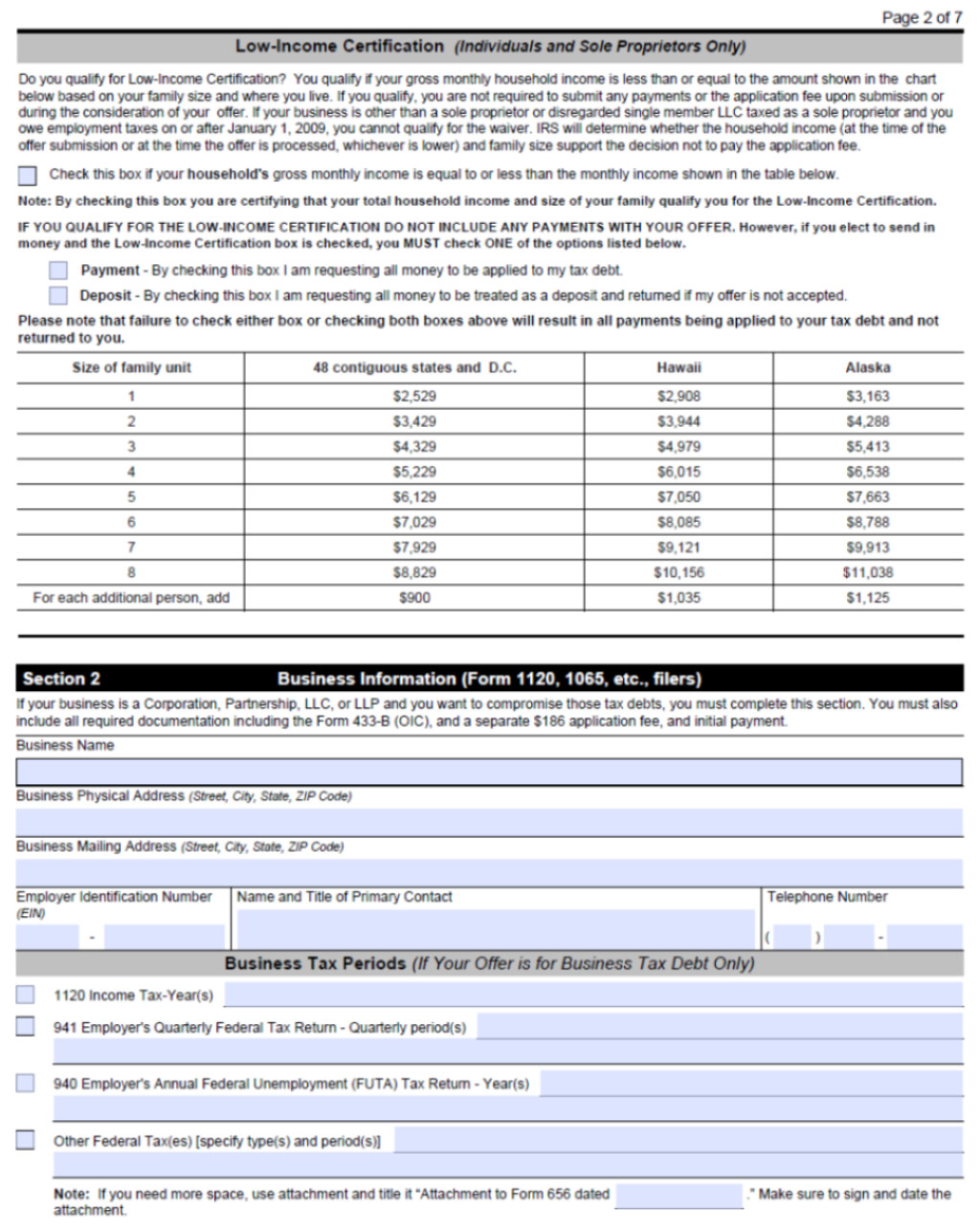

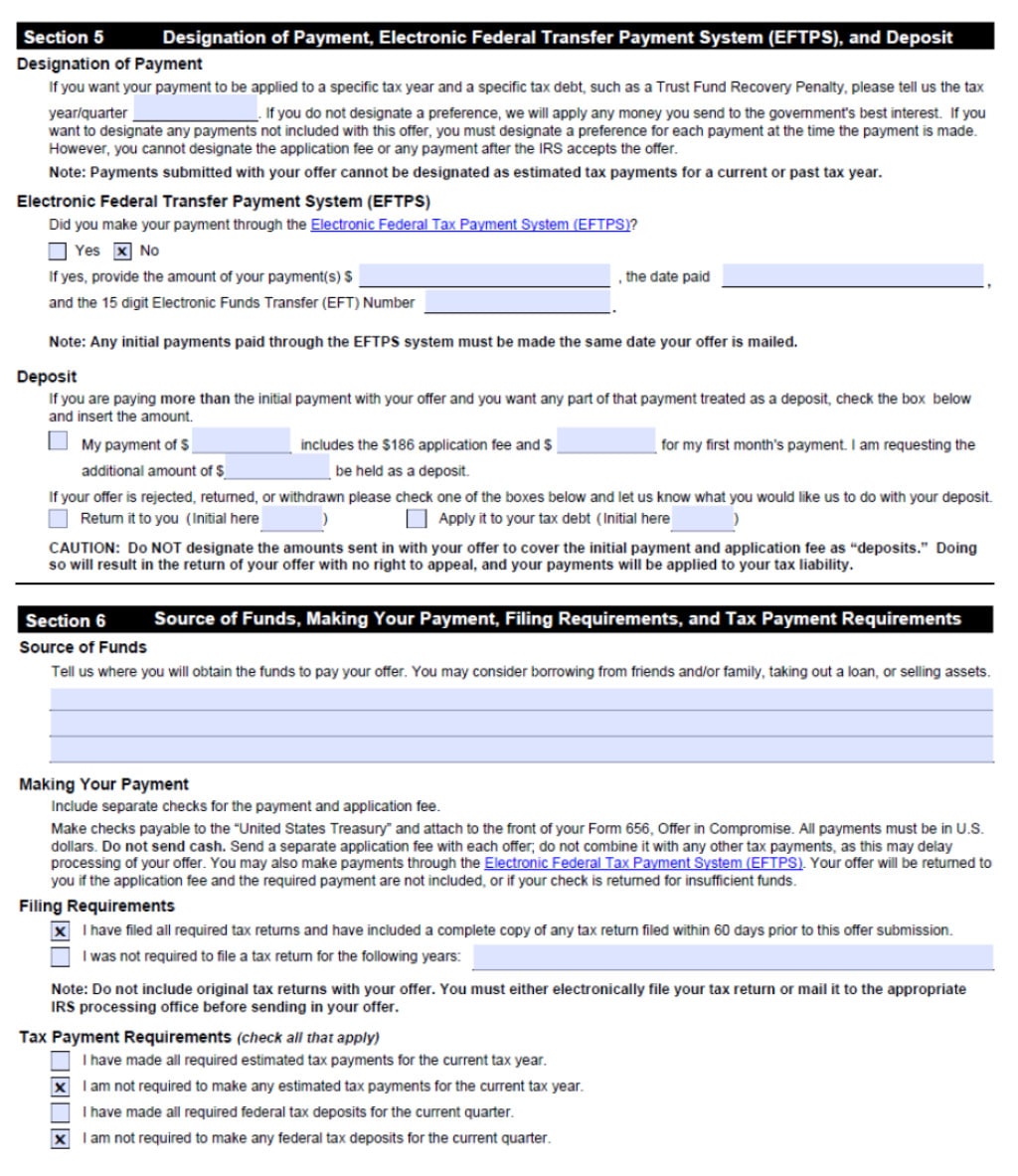

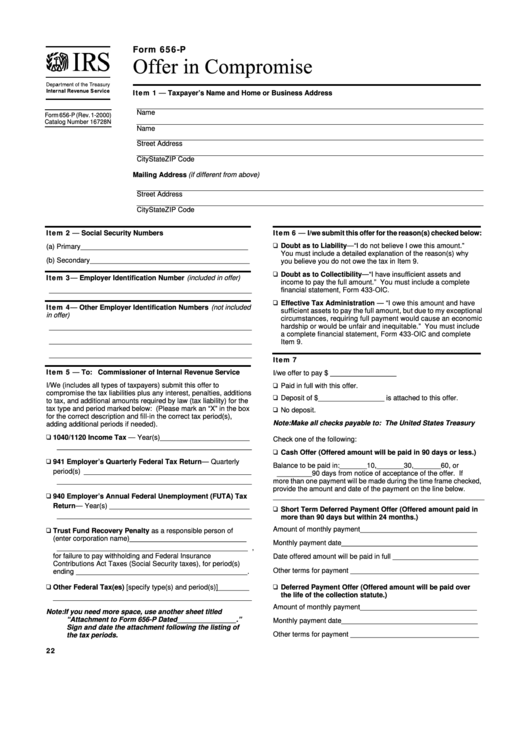

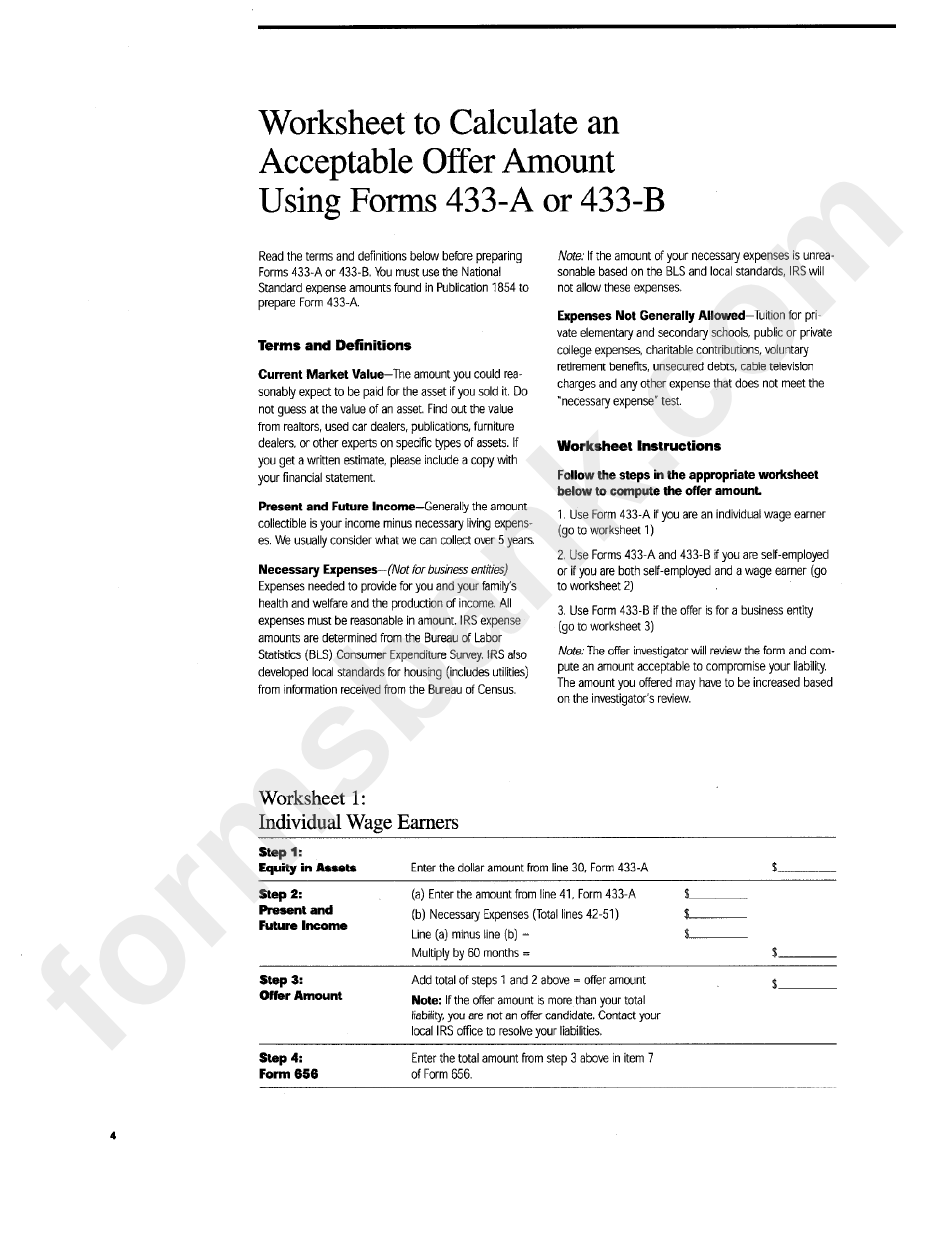

This form is part of the Form 656-Booklet, Offer in Compromise. Financial forms to let the IRS know about your monthly income, expenses, assets, and liabilities. These forms are also part of the Form 656-Booklet. Individuals submitting either a DATC or ETA offer should complete Form 433-A (OIC), Collection Information Statement for Wage Earners.

Form Ct656 Offer Of Compromise printable pdf download

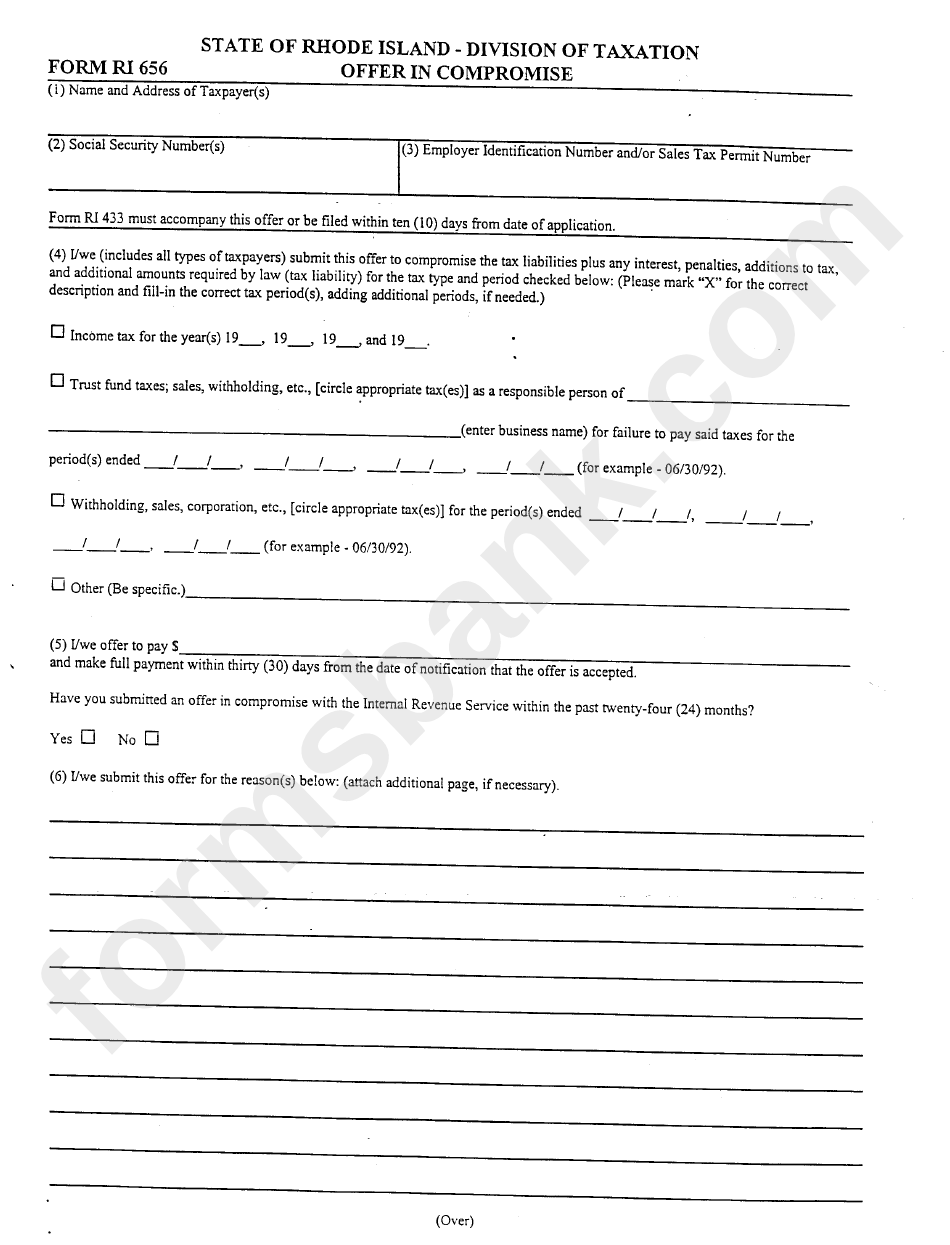

The goal is a compromise that's in the best interest of both the taxpayer and the agency. The application fee for an offer in compromise is $205. Low-income taxpayers don't have to pay this fee, and they should check if they meet the definition of low-income in the instructions for Form 656, Offer in Compromise.

How To Fill Out The IRS Offer In Compromise Form 656 Offer in

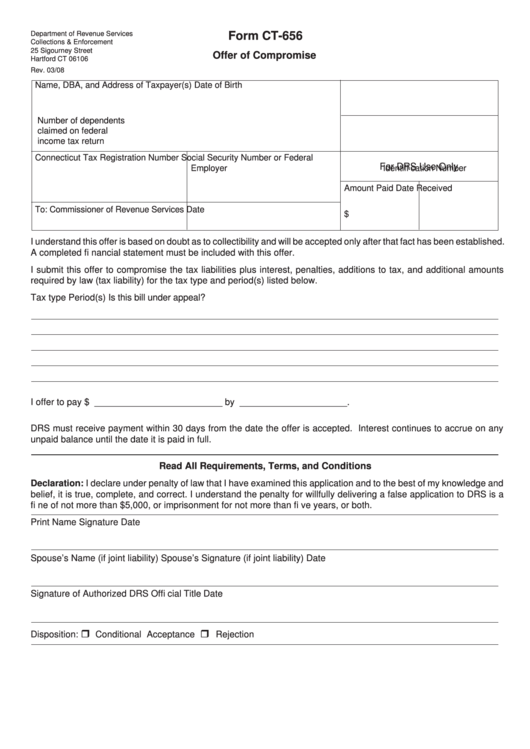

need to complete a Form 656-L, Offer in Compromise (Doubt as to Liability). The Form 656-L is not included as part of this package. To submit a Doubt as to Liability offer, you may request a form by calling the toll free number 1-800-TAX-FORM (1-800-829-3676), by visiting a local IRS office, or at www.irs.gov. Other important facts

Irs Offer In Compromise Form 656 L Universal Network

For an OIC based on doubt as to collectability or based on effective tax administration, download Form 656-B PDF, a booklet which includes instructions and the following forms: Form 656, Offer in Compromise; Form 433-A (OIC), Collection Information Statement for Wage Earners and Self-Employed Individuals

Offer in compromise How to Get the IRS to Accept Your Offer Law

The Offer in Compromise application includes a fee of $205 and an initial payment. Low-income taxpayers don't have to pay either the fee or the initial payment. Taxpayers should review the instructions for Form 656-B, Offer in Compromise PDF, to see if they meet the qualifications to have these initial costs waved. Who's eligible

Fillable Form 656 Offer In Compromise Department Of The Treasury

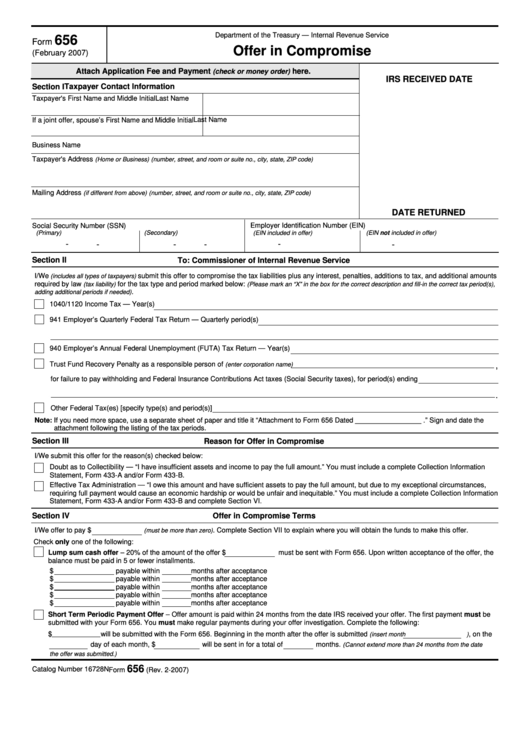

Form 656 - Offer in Compromise OIC. 1. An offer in compromise (offer) is an agreement between you (the taxpayer) and the IRS that settles a tax debt for less than the full amount owed. The offer program provides eligible taxpayers with a path toward paying off their debt and getting a "fresh start." The ultimate goal is a compromise that suits.

Offer in compromise How to Get the IRS to Accept Your Offer Law

Form 656 Offer in Compromise. I submit this ofer to compromise the tax liabilities plus any interest and penalties for the tax type and period below: (Please mark and "X" in the box for the correct description and fill-in the correct tax period(s), adding additional periods, if needed.) MARYLAND FORM. 656. COMPTROLLER OF MARYLAND.

Form 656L Offer in Compromise (Doubt as to Liability) (2012) Free

An OIC is a good option for some taxpayers dealing with IRS debt. These offers are approved about 40% of the time. You'll have to fill out Form 656 to make an offer in compromise to the IRS, which will include the details of your repayment offer. The catch is you'll have to prove that you don't have enough income or assets available to pay.

Irs Offer In Compromise Form 656 L Form Resume Examples goVLD7ZVva

He can be reached at (831) 372-7200. Please address any questions to Barry at P.O. Box 710 Monterey, CA 93942-0710 or email: [email protected]. Utilizing Form 656, Offer in Compromise, you may.

Form 656P Offer In Compromise printable pdf download

Follow the instructions in Form 656-B Booklet, Offer in Compromise, to prepare and file your offer. The booklet contains instructions on the required forms to submit, low-income waiver guidelines, payment options, offer terms and other information about the offer process. Note: Submitting an offer doesn't guarantee the IRS will accept your.

Fillable Form 656 Offer In Compromise printable pdf download

Photo: urbazon / Getty Images. Definition. Form 656 is a proposed contract for an offer in compromise to settle a tax debt with the IRS. Learn how to fill out the form and what it takes to make a successful offer.

Fillable Form 656 Offer In Compromise printable pdf download

Offer In Compromise Pre-Qualifier. Use this tool to see if you may be eligible for an offer in compromise (OIC). Enter your financial information and tax filing status to calculate a preliminary offer amount. We make our final decision based on your completed OIC application and our associated investigation.

Form Ri 656 Offer In Compromise printable pdf download

Understanding Form 656-B and the Offer in Compromise Process. Tackling tax debt can feel like facing a heavyweight champ, but IRS Form 656-B is your coach to help you negotiate a settlement. This form kicks off the Offer in Compromise (OIC) application, where you roll up your sleeves and show the IRS that paying your full tax bill would be an.

Irs Offer And Compromise Forms Fillable Pdf Printable Forms Free Online

The Internal Revenue Service (IRS) utilizes Form 656, also known as the Offer in Compromise (OIC) Booklet (Form 656-B), to guide taxpayers through the process of submitting an offer to settle their outstanding federal tax liabilities for less than the full amount owed. This booklet serves as a valuable resource for individuals and businesses.

- Alimentos Para Que Te Venga La Regla

- Base Militar San Fernando Cadiz

- Precio De Latex Interior Por 20 Litros

- En Que Equipo Juega Joao Cancelo

- Los 10 Países Más Poderosos Del Mundo

- Reemplazo Tapa Trasera Carcasa Cubierta Original Para Elephone P6000 Pro

- Maria De Las Mercedes Cerezo Saenz

- Traje Deportivo Adidas Para Hombre

- Toyota Corolla Gt Twin Cam 16v

- Impreso Solicitud Voto Por Correo Ministerio Del Interior