Bridge Loans Part 1 What Are They? Skylatus Property Capital

So, if you have made a $25,000 deposit with the offer, you will now need a downpayment of $225,000. $650,000-$400,000=$250,000-$25,000=$225,000. In addition to the downpayment needed, the bridge mortgage calculation determines how much equity you have available in your home. The APS for the sale of your home will give the lender the amount of.

Florida Memory • Looking east from new bridge at Moore Haven in the

Bridge financing, or bridge loans, are designed to provide temporary financial assistance for individuals or businesses. They are typically used to fill a gap in funding. Bridge loans are usually paid back within a year, and they often have higher interest rates than traditional loans. Examples of situations where a bridge loan could be right.

Bridge Loans Part 2 Pricing of Loans Skylatus Property Capital

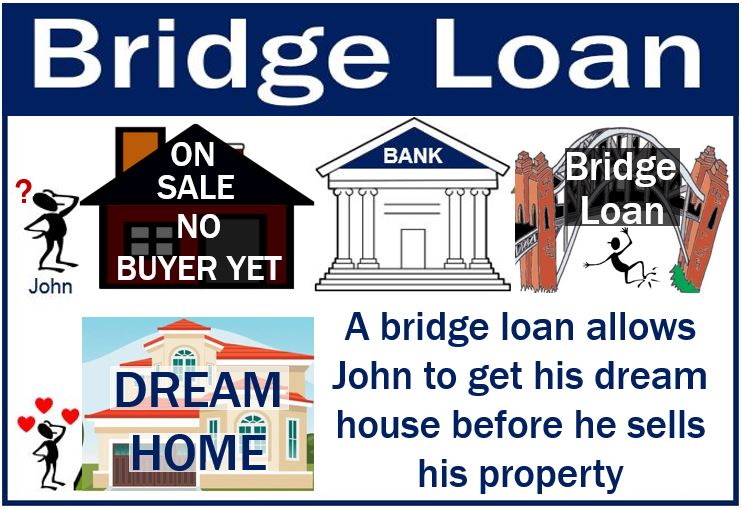

A bridge loan, also known as a swing loan, is a short-term loan taken out by an individual or a company until they can secure permanent financing. In real estate, it's a type of loan that uses the existing equity in your home to finance the purchase of a new house. Quick to take out and quick to pay back, most lenders will expect repayment.

Loan Officer Program The Bridge Loans, Inc.

Bridge loan rates for Moore-Haven, Florida start at 2.00% in 1st posion and 6.68% for bridge loans in 2nd postion . Lendersa® lenders' list includes all the financial institutions and private hard money lenders who can arrange Bridge Loans on residential or commercial properties in Florida.

What is a bridge loan? What is it for? Market Business News

Bridge Financing allows you to purchase and move into your dream home before your current home's closing date, bridging the gap between the two. Bridge Financing Loans are also great if you: move some furniture and clean your old house out for the new buyers before your big move. With Manulife Bank, you can carry the mortgage on both.

Moore Haven Railroad Swing Bridge in Moore Haven, FL, United States

The amount of the bridge loan is calculated by subtracting the deposit you made in cash from the profit you will eventually use to make the rest of the down payment. If you paid $10,000 as a deposit and want to use $140,000, based on the sale property's equity, as a downpayment, you would qualify for a $130,000 bridge loan.

BRIDGE LOANS HOW TO GET MORE OFFERS ACCEPTED YouTube

As you can imagine, bridging loans in Canada aren't free. Bridge financing usually comes with interest rates similar to a personal line of credit, often Prime + 2-3%. Plus, lenders will usually charge one-time administrative fees. Expect administrative costs between $300-$500, and sometimes legal fees.

Bridge Loans Mason Mortgage

Bridge loans can be important to consider when it comes to temporary financing. In this guide, we'll explore bridge loans, addressing key questions that prospective borrowers often encounter.What is a Bridge Loan?A bridge loan is a short-term loan that bridges the financial gap between buying a new property and selling an existing one. The bridge loan is used in place of your down payment.

How can you use bridge loans? in 2021 Personal loans, Loan, Bridge loan

In the world of finance, bridge loans have become increasingly popular as a short-term financing option. Whether you're a real estate investor, a small business owner, or an individual facing temporary financial gaps, understanding the fundamentals of bridge loans can be a game-changer. This blog post aims to provide you with a comprehensive introduction to

Bridge Loans How They Work and What You Need to Know YouTube

A bridge loan is a short-term loan that is provided until a client can secure other financing or remove an existing obligation. Essentially, bridge loans help to "bridge the gap" in circumstances when financing is required but is not available. Bridge loans are also commonly referred to as interim financing, swing loans or gap financing.

What is A Bridge Loan? Everything You Need to Know

Contact Us for Bridge Loans. If you are in need of a bridge loan to facilitate a smooth transition between properties, The Mortgage Firm is here to assist you. Contact our team at 226-785-0495 or fill out our online application form to get started. Let us help you bridge the financial gap and achieve your goals with confidence.

Bridge Loans Defined Bridge loan, The borrowers, Loan

To qualify for bridge financing in Canada, borrowers typically need to have a strong credit score and a significant amount of equity in their current property. They will also be required to provide proof of income and a clear timeline for the sale of their current property. Bridge loans are calculated based on the borrower's equity in their.

Bridge Loans For Investment Properties Lending Guidelines

A bridge loan will cover your equity over the 55-day period (90 days - 35 days). For example, let's say you are purchasing a $350,000 home and you made a 5% deposit ($350,000 x 0.05 = $17,500), but you want to put down the $165,000 of equity you have in your existing home. The trouble is your purchase close date is February 15th, 2014, and.

PPT Commercial Bridge Loans PowerPoint Presentation, free download

Term Lenght - Bridge Loans are short-term loans that can range between 90 days to 12 months or longer. Interest Rates - Interest rates for bridge loans are typically higher than regular mortgages. Repayment - No payment is required until your current home is sold or until the life of the loan has ended.

Bridge Loans in Greater Chicago and Nashville

DELAFIELD, Wis., July 27, 2021 /PRNewswire-PRWeb/ -- Prescient Capital Management recently closed a short-term bridge loan on a RV Park based in Moore Haven, Florida. The strategic goal of the Borrower was to use the proceeds from the Prescient Capital loan to refinance out of a seller-financed loan. The loan request is for $1,930,000, and.

What is a Bridge Loan? AMUSA Commercial Capital, Dallas/Fort Worth

A bridge loan will cover the 60 days in between. Here's how: If your current home is worth $300,000 and you owe $200,000 on your mortgage, you may be eligible for a $100,000 bridge loan. Once your current home sells, that equity is used to repay your bridge loan. Typically, most banks require confirmation that you have sold your home to a.

- Lana Mineral 50 Mm Rollo

- Gerencia De Infraestructuras Y Equipamiento De La Seguridad Del Estado

- Corsair K70 Rgb Mk2 Mecánico Cherry Mx Red Teclado Gaming

- Club De Tenis Y Padel Zamora

- 0 00 Cest Hora España

- All Codes Mtg Arena Reddit

- Letras Bate Harley Quinn Para Imprimir

- Rotaciones Colocadora 6 1 Voleibol

- Como Reparar Herramientas Lost Ark

- Juegos De Rompecabezas Para Armar Gratis Online